Open Banking in Australia - Opportunities in Retail Banking

Our perspective on Open Banking

Whilst there are still a number of issues being worked through on Open Banking in Australia and indeed the Data Standards for the Consumer Data Right (CDR), we believe that Open Banking has tremendous potential to:

- Drive greater empowerment and transparency for consumers

- Foster Innovation for the Australian economy

- Enhance competition in Banking and Financial Services

Open Banking provides tremendous opportunities for banks and indeed non-bank brands to compete with “the majors”. With a challenger mindset, the right strategy, customer focus and ecosystem collaborations, Open Banking can provide the means to increase market share, grow revenues and develop new digital propositions in adjacent markets.

In addition to the above, the right digital propositions have the ability to delight customers and enhance overall customer experience, not to mention the insights that can be gleaned from the additional customer data. We believe this aligns well with the inherent customer focus that smaller retail banks and indeed Community owned banks such as Credit Unions, etc.

Open Banking use cases

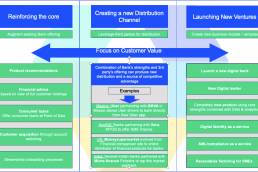

We have provided some high-level use cases below to serve as examples for retail banks when assessing the growth options that Open Banking presents.

These examples are from what we have seen working with Banks, Insurers and Fintech companies both domestically and in Europe and is intended to give a sense of what is possible in Retail Banking.

When considering which Open Banking strategies and use cases to execute upon, it is important to note that embarking upon an Open Banking transformation is certainly not a one size fits all proposition and is largely dependent on:

- The Bank’s Digital maturity

- The Bank’s Data maturity

- The ambition and overall strategy of the Bank

The use cases below are predominantly consumer focused as this is the current scope of the Consumer Data Right (CDR) but we’ve also put included a few Small to Medium Enterprise (SME) and Corporate use cases too as there are alternate ways to enable these despite these not being in scope of the Consumer Data Right, specifically.

The use cases in above are high level and intended to give a flavor of the opportunities that Open Banking presents in the near term and with some international examples of where these use cases have already been implemented to significant benefit.

Whilst executing on some of these is naturally dependent on the rollout schedule of the Consumer Data Right and the Open Banking regime in Australia, there are a significant number of examples that can be executed upon prior to this implementation going live or indeed in parallel.

Possible Open Banking use cases

Data Collaborations

In addition to Open Banking opportunities that leverage the Application Programming Interfaces (API) developed as part of the Consumer Data Right, there are also a tremendous number of potential growth opportunities that can be realised through secure data collaborations with trusted third parties. Such collaborations can support and compliment an overall Open Banking strategy.

Whilst we haven’t gone into any detail here, some examples that could be executed through third party collaborations include:

- Leveraging bank data in combination with 3rd party data to enhance credit scores across personal, business and home loan customers

- Fraud detection and Anti-Money Laundering compliance detection

- Customer Marketing: Better segmentation, enhanced recommendations and personalisation, etc.

- Provide entirely new data products to market and add new revenue lines

Vanteum has supported large Financial Services organisations with collaborations such as these previously.

Summary

To be successful in Open Banking, retail banks need to create a strategy based on their current starting point and identify and prioritise use cases and marketing possibilities as well as select prospective partners as well as create clear execution plans. Many domestic and international banks have benefited from outside experience through this process and to fully realise Open Banking’s potential.

If you’d like to discuss Open Banking and what it means for Retail Banking, Insurance, Wealth Management and indeed to sectors beyond traditional financial services, please get in touch.

Get in touch with us

Some of our clients

Copyright Vanteum 2019